The smart Trick of How Do I Get A Copy Of Bankruptcy Discharge Papers That Nobody is Talking About

Getting The How Do You Get A Copy Of Your Bankruptcy Discharge Papers To Work

Table of ContentsGetting My How Do You Get A Copy Of Your Bankruptcy Discharge Papers To WorkHow To Obtain Bankruptcy Discharge Letter Things To Know Before You Get ThisIndicators on Obtaining Copy Of Bankruptcy Discharge Papers You Should KnowNot known Facts About How Do I Get A Copy Of Bankruptcy Discharge PapersSome Known Questions About How Do You Get A Copy Of Your Bankruptcy Discharge Papers.Copy Of Bankruptcy Discharge Things To Know Before You Get This

Among the factors people file personal bankruptcy is to obtain a "discharge." A discharge is a court order which mentions that you do not need to pay the majority of your financial obligations. Some financial obligations can not be released. As an example, you can not discharge financial debts for a lot of taxes; child support; alimony; many trainee lendings; court penalties as well as criminal restitution; and also injury brought on by driving drunk or under the impact of drugs.

You can just receive a chapter 7 discharge once every eight years. Other regulations may apply if you previously obtained a discharge in a chapter 13 situation. No one can make you pay a debt that has actually been released, yet you can voluntarily pay any type of financial debt you wish to pay.

Excitement About Bankruptcy Discharge Paperwork

Some financial institutions hold a safeguarded claim (for instance, the bank that holds the mortgage on your residence or the lender that has a lien on your vehicle). You do not have to pay a secured claim if the financial obligation is discharged, however the lender can still take the property.

If you are a specific and you are not represented by an attorney, the court must hold a hearing to decide whether to approve the reaffirmation agreement. The agreement will certainly not be legitimately binding till the court accepts it. If you declare a financial debt and after that fall short to pay it, you owe the debt the like though there was no personal bankruptcy - https://robertingram.doodlekit.com/.

The 25-Second Trick For Chapter 13 Discharge Papers

The financial institution can likewise take lawful action to recuperate a judgment versus you - https://is.gd/d7gA50. Revised 10/05.

To request court documents online, please full the form listed below (https://anotepad.com/notes/eai83xpf). If you are requesting to assess court records at the courthouse, you will certainly be spoken to when the instance file is offered to this content examine. If you are asking for to purchase copies of court records, you will certainly be contacted with expense as well as a distribution time estimate.

Do NOT send your social protection number, bank or bank card information with this website. The staff can not ensure the safety and security of info or records sent out through this website. Furthermore, any type of document, documents, or files sent out to the staff using this site might be disclosed according to Florida's Public Records Law.

Some Known Facts About How Do You Get A Copy Of Your Bankruptcy Discharge Papers.

A Phase 13 insolvency discharge is a very effective thing. It stops your creditors from pursuing discharged debts permanently. It can likewise be puzzling. Let's respond to a few of the typical questions regarding the Phase 13 discharge. A "discharge" is the elegant legal term for your financial debts being forgiven in your personal bankruptcy.

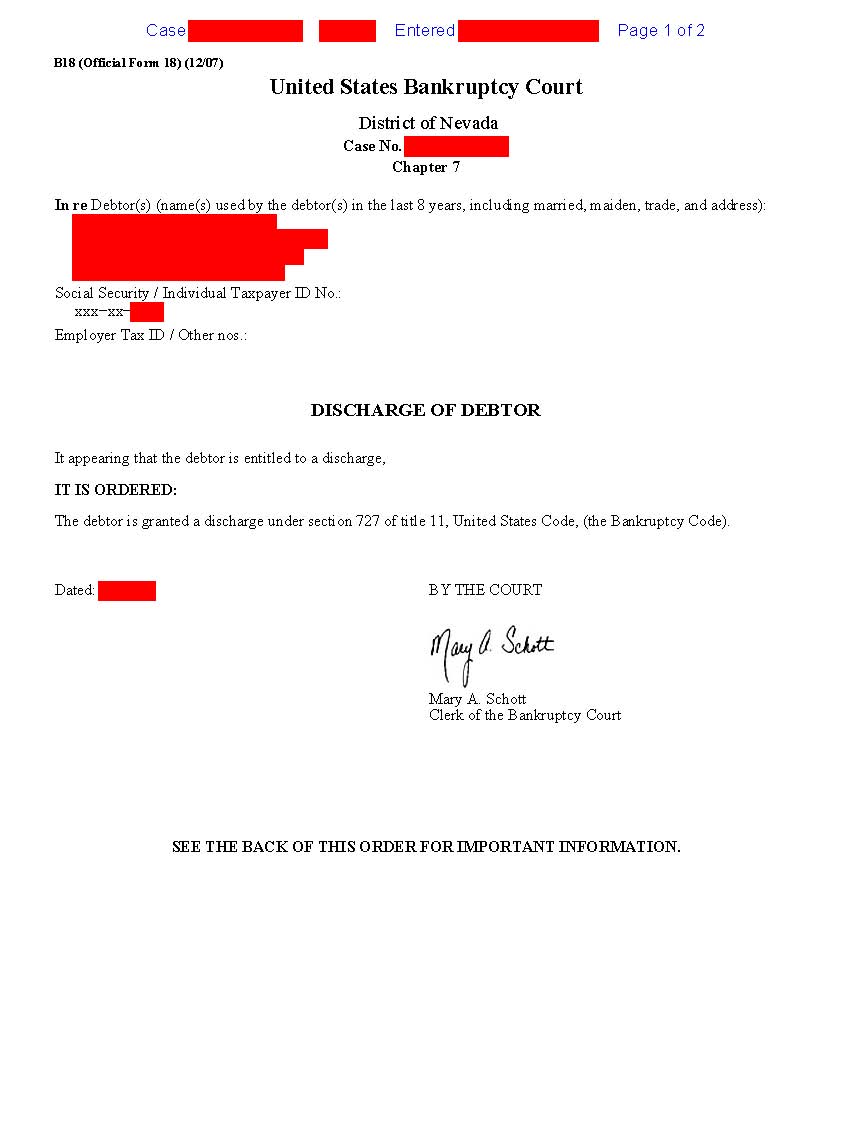

The Phase 13 "discharge order" is the final order you receive in your Phase 13 insolvency. It is signed by the personal bankruptcy court designated to your situations and states clearly that you have actually obtained a Phase 13 discharge. In other words, it is the official record that launches you of your debts.

We ought to keep in mind that there are two types of discharge under Chapter 13. The 2nd is called a "hardship discharge" and is occasionally called an Area 1328(b) discharge.

5 Simple Techniques For How To Obtain Bankruptcy Discharge Letter

While every court is somewhat various, the Phase 13 discharge order looks comparable. As soon as you get your discharge, your lenders are "urged" from pursuing the debt.

We generally see this in instances where debt collection firms continue to send payment demands also though the individual received the discharge. One of the best points concerning bankruptcy is that your financial obligation is released tax free - how to obtain bankruptcy discharge letter.

You would certainly have to pay tax obligation on any type of cash forgiven by the financial debt collection agency. In insolvency, the discharge makes it so that the financial obligation forgiveness is not taxable. It's an accountancy problem for the lender.

6 Easy Facts About Copy Of Chapter 7 Discharge Papers Explained

, but usually, you will certainly receive the discharge order concerning 1-3 months after finishing your Chapter 13 strategy settlements. The size of your Chapter 13 plan varies from case to situation.

The majority of financial debts are dischargeable in Chapter 13 with a couple of exceptions. So we generally begin by presuming the debt is dischargeable unless an exemption applies. The typical exemptions to dischargeability are: The Chapter 13 discharge is much much more thorough than the Chapter 7 discharge. Much more financial obligations are dischargeable in Phase 13 than in Chapter 7.